2 Warren Buffett Stocks To Buy Hand Over Fist and 1 To Avoid

Most of them are always worth buying. Every now and then, even the Oracle of Omaha misses something important.

If you’re ever in need of a new stock pick, you can always borrow an idea or two from Berkshire Hathaway‘s (BRK.A 0.55%) (BRK.B 1.06%) portfolio of holdings hand-picked by Warren Buffett himself. And you should. Given enough time, Berkshire shares consistently outperform the broad market largely due to the conglomerate’s investments in publicly traded companies.

Not every Berkshire Hathaway holding is always a great buy, however. Sometimes they’re trading at too steep of a valuation for newcomers, and other times, they’ve just turned into clunkers.

With that as the backdrop, here’s a closer look at two Warren Buffett stocks you can feel good about buying today, but one name you might want to avoid until something big changes for the better.

Image source: The Motley Fool.

Buy: American Express

Many investors don’t realize that — through the attrition of other holdings as well as its own growth — credit card outfit American Express (AXP 0.55%) is now Berkshire Hathaway’s second-biggest stock holding, accounting for 17% of the outfit’s portfolio of publicly traded equities. Underscoring this bullishness is the fact that Berkshire also holds stakes in Visa and Mastercard, but has chosen to only hold much smaller positions in both.

Then again, it’s not difficult to see what the Oracle of Omaha has seen in AmEx since first establishing the position back in the 1990s. It’s not just a payment middleman like the aforementioned Mastercard and Visa. It operates an entire consumerism ecosystem, serving as the card issuer as well as the payment processor, while also managing a perks and rewards program that’s attractive enough for some members to pay up to $900 per year to hold the plastic. These perks include credit toward hotel stays and ride-hailing, cash back on grocery purchases, and discounted entertainment, just to name a few. Although some have tried, no rival has been able to successfully replicate this offering.

Of course, it’s worth pointing out that American Express’s cardholders tend to be a bit more affluent than average, and are therefore mostly unfazed by economic soft patches. As CEO Stephen Squeri pointed out of its Q2 numbers despite the turbulent economic backdrop at the time, “Our second-quarter results continued the strong momentum we have seen in our business over the last several quarters, with revenues growing 9 percent year-over-year to reach a record $17.9 billion, and adjusted EPS rising 17 percent.”

Buy: Kroger

It’s not a major Berkshire holding, and certainly not one that’s talked about much by Buffett (or anyone else, for that matter). But Kroger (KR -0.08%) is quietly one of Berkshire Hathaway’s best-performing stocks.

You know the company. With 2,731 stores producing annual sales on the order of $150 billion, Kroger is one of the country’s biggest grocery chains. Oh, it doesn’t grow very quickly, or produce a ton of profit; this year’s expected top-line growth of around 3% is only likely to lead to operating income of a little less than $5 billion. That’s just the nature of the well-saturated, low-margin food business.

What Kroger lacks in growth firepower, however, it makes up for in surprising consistency.

Although the volatile food business doesn’t exactly lend itself to it, not only has this company not failed to produce a meaningful full-year profit every year for over a decade now, but has roughly doubled its bottom line during this stretch. Making a point of remaining relevant by doing things like entering the e-commerce realm has helped a lot.

More important to would-be investors, although the grocer’s reported growth doesn’t seem all that impressive, the company’s found other ways to create considerable shareholder value. Its quarterly dividend payment has grown by a hefty 250% over the course of the past decade, for example, boosted by stock buybacks that have roughly halved the number of outstanding Kroger shares. In fact, reinvesting Kroger’s dividends in more shares of the increasingly scarce stock over the course of the past 30 years would have consistently outperformed an investment in the S&P 500 during this stretch.

Avoid: UnitedHealth Group

Finally, while Buffett was willing to dive into a small position in beleaguered health insurer UnitedHealth Group (UNH -0.43%) a few weeks back, you might not want to do the same just yet…if ever.

But first things first.

Yes, there’s some drama here. UnitedHealth shares have been beaten down since April, starting with a surprise shortfall of its first-quarter earnings estimates, followed by then-CEO Andrew Witty’s abrupt resignation for “personal reasons” in May. Then in July, the company confirmed that the U.S. Department of Justice was investing its Medicare billing practices. Its second-quarter earnings posted later that same month also missed analysts’ estimates due to the same high reimbursement costs that plagued its first-quarter results. All told, from peak to trough, UNH stock fell 60% in the middle of this year.

As Buffett himself has said, of course, you should be fearful when others are greedy, and greedy when others are fearful. Taking his own advice, he recently plowed into a stake in a long-established company that’s likely to be capable of overcoming all of its current woes. Berkshire now owns 5 million shares of UNH that are currently worth a little less than $2 billion.

Except, maybe this is one of those times you don’t follow Buffett’s lead, recognizing that UnitedHealth Group — along with the entire healthcare industry — seems to be running into these regulatory and pricing headwinds more and more regularly. UnitedHealth’s Medicare business ran into similar legal trouble back in 2017, for instance, while its pharmacy benefits management arm OptumRX was sued by the Federal Trade Commission just last year for artificially inflating insulin prices. It would also be naïve to not notice the federal government is increasingly scrutinizing every aspect of the nation’s healthcare industry, now that care costs have raced beyond reasonable affordability.

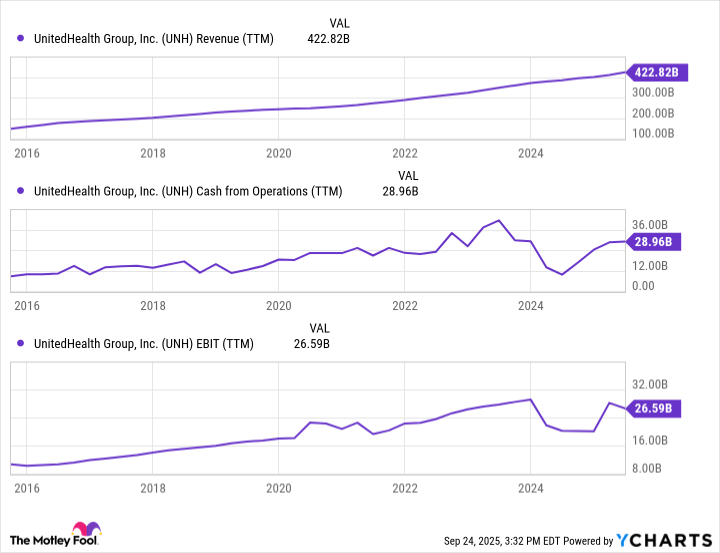

And for what it’s worth, although UnitedHealth has managed to continue growing its top line every year for over a decade now, actual operating profits and EBITDA stopped growing early last year, not counting the recent unexpected surges in its medical care costs.

UNH Revenue (TTM) data by YCharts

What gives? The entire healthcare industry may be at a tipping point, so to speak, and not in a good way. Although this wouldn’t necessarily be catastrophic for UnitedHealth, it certainly would undermine its value to investors. If nothing else, you might want to wait on the sidelines for the proverbial dust to settle before following Buffett into this uncertain trade.