Crypto Funds See $321 Million Inflows amid Dovish FOMC Comments

Coinspeaker

Crypto Funds See $321 Million Inflows amid Dovish FOMC Comments

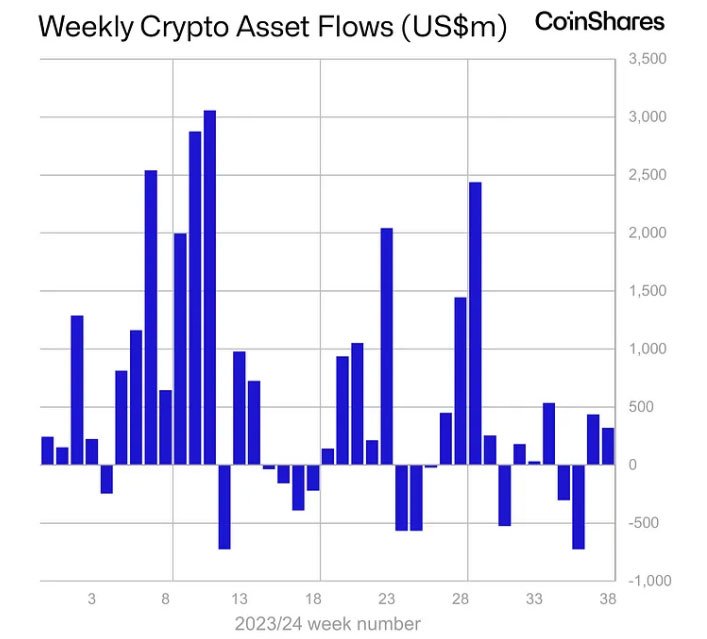

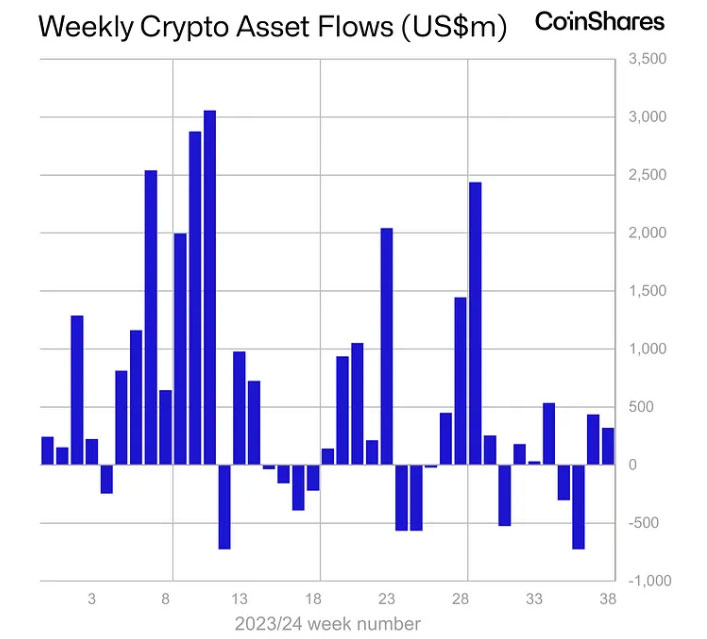

The global crypto investment market experienced a notable recovery last week, with net inflows reaching $321 million across various digital asset products. This significant rebound followed two consecutive weeks of outflows, signaling renewed investor confidence in the crypto sector.

Asset managers giants such as BlackRock, Fidelity, Bitwise, and Grayscale were key contributors to the surge. Their involvement shows the growing institutional interest in digital assets. The recovery is also tied to recent developments from the Federal Open Market Committee (FOMC), which adopted a more cautious approach than anticipated.

According to CoinShares Head of Research James Butterfill, the FOMC’s decision to cut interest rates by 50 basis points last Wednesday played a crucial role in boosting market sentiment, creating a more favorable environment for investors, and encouraging capital flow into crypto products.

Photo: CoinShares

As a result, total assets under management (AUM) in crypto funds rose by 9%, reaching $9.5 billion. Trading volumes also saw a 9% increase compared to the previous week, further highlighting the market’s strengthening momentum.

Bitcoin Dominates the Surge

Bitcoin-based products led the charge, accounting for $284 million of the net inflows. The bullish momentum in Bitcoin not only attracted long-term investors but also led to a notable influx of $5.1 million into short-bitcoin products, reflecting a diverse market sentiment.

While Bitcoin

BTC

$63 106

24h volatility:

0.8%

Market cap:

$1.25 T

Vol. 24h:

$32.13 B

maintained its dominance, Solana-based funds also saw continued gains, with $3.2 million in inflows during the same week. The announcements made at the Solana Breakpoint conference in Singapore played a pivotal role in bolstering these investments.

Meanwhile, Ether products extended their decline with net outflows of $29 million, marking the fifth straight week of losses. During this period, Ether funds have seen total outflows reach $187.7 million. Notably, Grayscale’s ETHE fund, known for its high fees, continues to be the largest contributor to these losses. Despite this, US spot Ethereum ETFs, launched in July, have attracted $2.2 billion in inflows.

Regional Differences in Fund Flows

Geographically, US-based funds were at the forefront, securing the lion’s share of inflows with $277 million. Switzerland emerged as a strong contender, registering its second-largest weekly inflow of the year with $63 million. In contrast, investment products in Germany, Sweden, and Canada experienced outflows, amounting to $9.5 million, $7.8 million, and $2.3 million, respectively.

This regional disparity underscores the varying investor sentiment across global markets. While the U.S. and Switzerland saw renewed interest in crypto investments, other regions continued to exhibit caution amid fluctuating market conditions.

As the global crypto market navigates this recovery phase, it remains to be seen whether these inflows can sustain momentum or if upcoming macroeconomic factors will once again temper investor optimism. However, the ongoing market recovery serves as a testament to the resilience of the crypto space and its ability to adapt to shifting regulatory and financial landscapes.

Crypto Funds See $321 Million Inflows amid Dovish FOMC Comments