Is MP Materials the Smartest Investment You Can Make Today?

MP Materials’ stock price has skyrocketed on positive news, but there’s still a lot of work to be done.

One of the many big geopolitical stories in the world today is the changing tariff regime in the United States. Key trading partner China is retaliating in a way that only China can, by limiting access to rare-earth metals, which are vital in the technology sector.

And that has led to a huge boon for MP Materials (MP -10.99%), which produces rare-earth metals in the United States. Does this make MP Materials a smart buy?

Image source: Getty Images.

What’s going on in the tariff world?

The new administration in Washington D.C. is raising tariffs on foreign countries that export products to the U.S. market. Given that U.S. consumers represent a valuable customer group, the tariffs are a very big deal. Impacted countries are attempting to negotiate and/or retaliate in an effort to limit the impact that tariff changes will have on their economies. China is one of the largest exporters to the United States and negotiations have been tense.

China’s wild card is the fact that it is the world’s largest producer of rare earth metals. These metals are used in electronics, including in highly sensitive high-tech gear that might be used for defense purposes. In the face of U.S. tariffs, China has been more than willing to limit access to rare-earth metals. And that is potentially a large problem for the United States.

This is where MP Materials comes in, since it is a U.S.-based supplier of rare earth metals. It didn’t just appear overnight, the company went public a few years ago. The whole idea of the business is to produce rare earth metals from within a politically and economically stable country, giving technology-driven customers what might be seen as a more reliable supply option for these vital materials. In hindsight, MP Materials’ timing could hardly have been any better.

There have been big investments in MP Materials

The importance of MP Materials is highlighted by two big events. First, on July 10, the U.S. government made a $400 million investment in the business, which included convertible securities. Second, and just five days later, Apple announced a $500 million partnership with MP Materials around rare-earth metals.

Not surprisingly, MP Materials’ stock price rose dramatically on the news. That, in turn, allowed MP Materials to sell $650 million worth of stock at attractive prices for the company. Demand for the shares was so high that the sale was upsized from $500 million, showing that investor appetite for MP Materials’ story is large. And why not? The story is quite compelling.

There’s just one problem. MP Materials is still building out its business. It likely has ample cash to do that today, but there is still material execution risk. If building the business, which has both mining and processing aspects to it, doesn’t go smoothly, investors could quickly turn negative on the stock. Similarly, if tariff tensions ease, the excitement around MP Materials could also wane. Notably, the bottom of the company’s income statement is in the red.

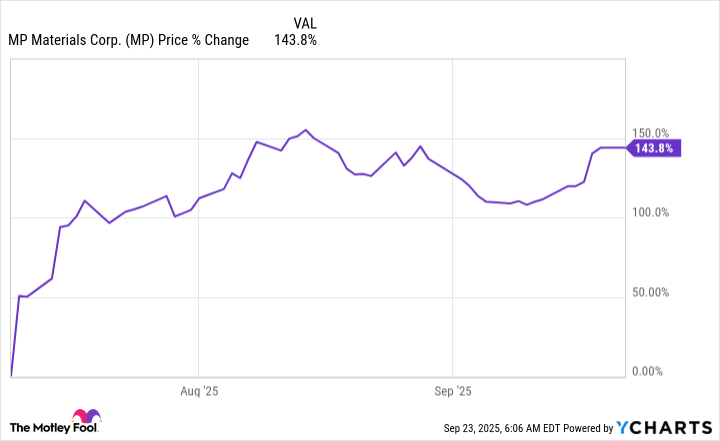

The fact that MP Materials is losing money as it makes the large capital investments needed to build out its business is hardly surprising. The problem is that investors are likely buying the short-term rare earth metals story, not the upstart business story. The second story, which is fundamental to the business right now, could require years to play out. And yet MP Materials’ stock price has risen more than 140% since July 9, the day before the government investment was announced.

Thinking long term will be key

At this point, it looks like a lot of good news has been priced into MP Materials’ stock. That has diminished the opportunity here for investors, even though the opportunity for the business looks very attractive. If you buy MP Materials today, it would be a smart move to think long term because in the short term, any negative news could lead to a swift drawdown in what has become a story stock.

That said, conservative investors will probably want to watch from the sidelines for a little bit to see how well MP Materials executes on its investment plans. The company has plenty of cash to work with at this point, but it still needs to make good use of that money for the quick stock price advance to make financial sense for investors.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends MP Materials. The Motley Fool has a disclosure policy.