Is Walmart a Buy, Sell, or Hold in 2025?

Here’s a look at Walmart after its recent drop.

The state of the consumer remains a hot topic as inflation pressures persist and shoppers continue to seek value. One company that could benefit from the current economic conditions is Walmart (WMT 1.84%), a favorite retailer among price-conscious shoppers.

Walmart stock has dropped nearly 20% from its all-time high in February. Let’s review its latest earnings results, management capital allocation strategy, and outlook to determine whether it’s a buy, sell, or hold.

Walmart continues to grow, but profitability lags

Walmart recently reported its fourth-quarter fiscal 2025 results. It generated an incredible $180.6 billion in revenue, representing a 4.1% year-over-year increase. However, the retailer saw its net income decrease from $5.7 billion to $5.3 billion.

The company faced higher costs of sales (up 3.3% year over year) and higher operating, selling, general and administrative expenses (up 6.5% year over year). Regarding the latter increase, management pointed to growing e-commerce sales, which now make up 18% of Walmart’s net sales, and cost more than its traditional brick-and-mortar stores. In the long term, management believes that supply chain automation will improve those expenses.

WMT Revenue (Quarterly) data by YCharts.

Walmart prioritizes returning capital to shareholders

As for what Walmart is doing with its profits, the company spends approximately half of them returning capital to shareholders through quarterly dividends and share repurchases.

Notably, the company holds the prestigious title of Dividend King, signifying that it has not only paid but also increased its dividend for at least 50 consecutive years. Its most recent dividend hike — its 52nd in a row — was an impressive 13%, bringing the quarterly payout to $0.235 per share. This translates to an annual yield of 1.1%.The company also has a relatively low payout ratio — the percentage of earnings paid out as dividends — at around 34%, meaning future increases likely won’t pressure the company’s other goals.

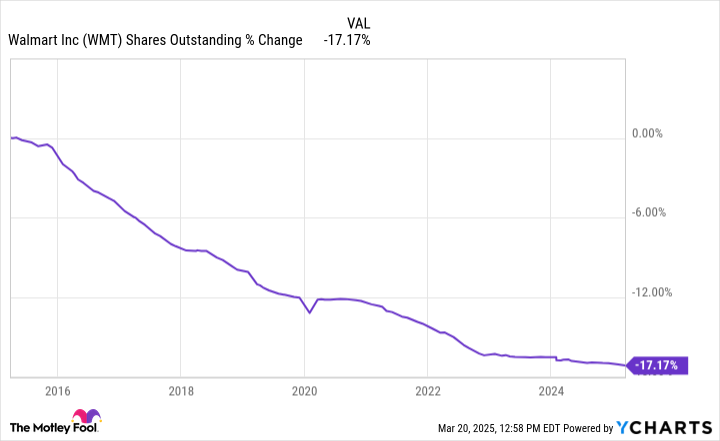

Walmart allocated $4.5 billion to share repurchases in fiscal year 2025, using a tax-efficient method of returning capital to shareholders. Unlike dividends, which trigger a taxable event for recipients, buybacks increase each remaining shareholder’s ownership stake without immediate tax consequences. With $12 billion still available under its current repurchase program, management will likely continue further lowering its outstanding shares, which have declined 17% over the past decade.

WMT Shares Outstanding data by YCharts.

Here’s what lies ahead for Walmart

Amid a potentially rocky economic outlook with uncertainty around tariffs and rising unemployment rates in the U.S., Walmart’s management remains cautiously optimistic for its fiscal year 2026.

“Our outlook assumes a relatively stable macroeconomic environment but acknowledges that there are still uncertainties related to consumer behavior and global economic and geopolitical conditions,” CEO Doug McMillon noted on the company’s most recent earnings call. “We remain confident that Walmart is well-positioned to navigate as it has over the last several years while continuing to deliver value for customers and shareholders alike.”

Digging into the outlook specifics for Walmart’s fiscal year 2026, management projects net sales growth of 3% to 4% and adjusted earnings per share (EPS) between $2.50 and $2.60. If the latter were to actualize, it would represent little to no growth from fiscal year 2025’s EPS of $2.51. Notably, management cited a higher effective tax rate and foreign exchange headwinds, which are expected to reduce EPS by $0.05 per share.

In the long term, management believes membership growth with Walmart+, its warehouse retailer brand Sam’s Club, and its advertising business will be a growth driver. The company’s “membership and other income” segments grew from $5.5 billion in fiscal year 2024 to $6.5 billion in fiscal year 2025, or 17.5%. Additionally, the company’s global advertising segment increased 27% year over year to approximately $4.4 billion.

What to do with Walmart’s stock

Before buying any stock, it’s crucial to assess its valuation. For a mature, profitable company like Walmart, the price-to-earnings (P/E) ratio is a useful metric, as it allows you to compare its current valuation to historical averages. Currently, Walmart trades at 35.6 times earnings, above its five-year median of 31, suggesting a premium valuation.

Financial stability is another key factor. Walmart carries $30 billion in net debt, which cost $2.3 billion to service in fiscal year 2025. While the company reduced its net debt by 25% over the past three years and can comfortably manage its obligations, the debt still weighs on the business and can limit growth opportunities.

Overall, Walmart stock isn’t a screaming “buy” due to its high valuation and sluggish earnings growth. However, Walmart’s valuation shouldn’t scare off income-seeking investors, as the company’s dividend longevity and growth make it a solid long-term hold.

WMT PE Ratio data by YCharts.